Buy Steroids with Wise

Simplifying International Payments: A Guide to Using Wise Payments

In our increasingly interconnected world, conducting transactions across borders has become a common occurrence for individuals and businesses alike. However, traditional methods of international payments often come with hefty fees, lengthy processing times, and complicated processes. Enter Wise Payments, a fintech solution revolutionizing the way we transfer money globally. In this article, we'll delve into what Wise Payments is and how you can use it to make your international transactions seamless and cost-effective.

Understanding Wise Payments

Formerly known as TransferWise, Wise is an online money transfer service founded in 2010 with the mission to make international banking cheaper, faster, and more transparent. One of the key features that sets Wise apart is its use of peer-to-peer technology, which allows users to transfer money abroad at the real exchange rate with only a small, transparent fee.

How to Use Wise Payments

Using Wise Payments is remarkably straightforward. Here's a step-by-step guide to get you started:

Sign Up: Begin by creating an account on the Wise platform. You can register using email address, Google, or Meta account.

Verify Your Identity: To comply with regulatory requirements, Wise will need to

verify your identity. This usually involves providing some form of identification, such as a passport or driver's license.

Initiate a Transfer: Once your account is verified, you can initiate a transfer by entering the recipient's details, including their bank account information and the amount you wish to send.

Choose Your Currency: Specify the currency you're sending and the currency you want the recipient to receive. Wise will then show you the exchange rate and any fees associated with the transfer.

Review and Confirm: Before finalizing the transaction, review the details to ensure everything is accurate. You'll also see an estimate of when the money will arrive at its destination.

Fund Your Transfer: Depending on your location, you can fund your transfer via bank transfer, debit card, or credit card.

Track Your Transfer: Once the transfer is initiated, you can track its progress through the Wise platform. You'll receive notifications at each stage of the process, from when the money leaves your account to when it reaches the recipient.

Money Received: Once the transfer is complete, the recipient will receive the funds directly into their bank account.

Benefits of Using Wise Payments

Using Wise Payments offers several advantages over traditional methods of international money transfer:

Cost-Effective: Wise charges a small, transparent fee for its services, typically lower than those of banks and traditional money transfer services. Additionally, by offering the real exchange rate, Wise ensures you get more value for your money.

Speed: Transfers through Wise are often faster than those through banks, with many transactions completing within a few hours, depending on the currencies involved.

Transparency: With Wise, there are no hidden fees or unexpected charges. You'll know exactly how much you're paying upfront, allowing for better budgeting and planning.

Convenience: Wise's user-friendly platform makes it easy to initiate and track transfers from anywhere, at any time, using your computer or mobile device.

Security: Wise employs robust security measures to protect your money and personal information, giving you peace of mind when conducting transactions online.

Conclusion

In an era where global connectivity is the norm, having a reliable and cost-effective way to transfer money internationally is essential. Wise Payments offers a solution that is not only cheaper and faster than traditional methods but also more transparent and convenient. Whether you're sending money to family overseas, paying international suppliers, or receiving payments from clients abroad, Wise makes the process simple and hassle-free. So why pay more for international transfers when you can Wise up?

Is It Possible To Pay With Wise At Getroids1.net? What Should I Do To Pay With Wise?

What is WiseAPP and How to use it?Transfer Wise with USD Bank account is suitable for all your USD currency transactions from all over the WORLD including USA home transactions!WiseAPP Allows worldwide payments in US currency with credit card or bank account. You can use WiseAPP for business and personal.

Get started:

You will use this link to send money https://wise.com/tr/send-money/USD currency Bank account details are listed below:

Account holder: ******

ACH and Wire routing number: *******

Account number: ************

Account type: Checking

Wise's address: *****

New York NY 10010

United States

Please provide us

- Transaction REF number (Provided by Wiseapp)

- Exact amount sent in USD currency

- Full sender name

- Date of transaction

- Order number

Important notices:

1- Do not forget to add Purpose of Payment your INTERNAL ORDER ID( Example: Payment for ORDER Get333)

2- Please do not forget to mail us 9 digits Transaction REF number which was provided by Wiseapp

You can get detailed info by watching Youtube Video

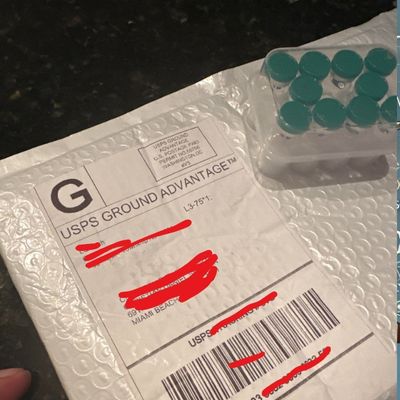

Customer Reviews

Discover real user experiences and explore our products.